44 what is coupon for bond

Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis.

What is coupon for bond

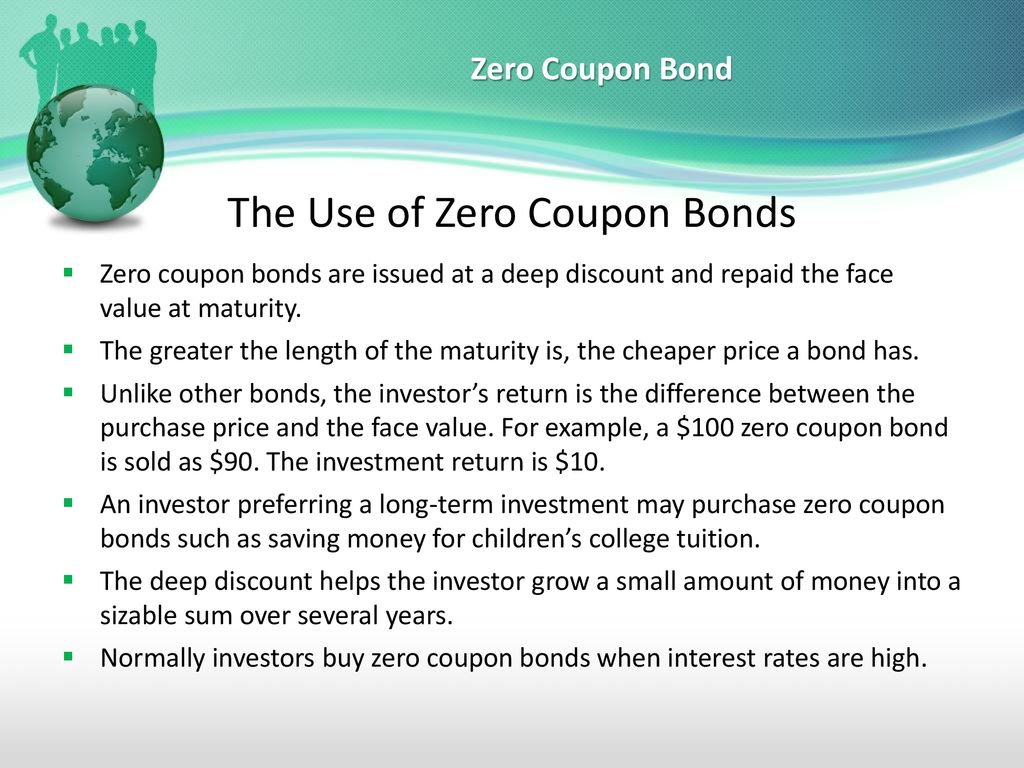

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ... › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

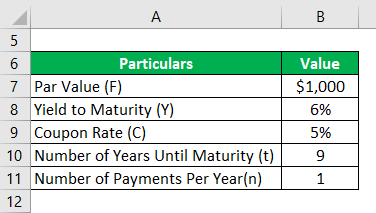

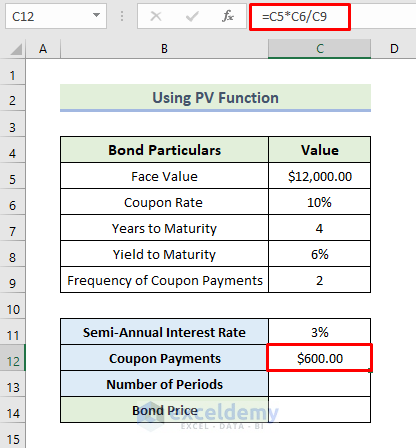

What is coupon for bond. › coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Bond Pricing - Formula, How to Calculate a Bond's Price Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The term "coupon bond" (CB) refers to the type of bond which includes coupons that are paid periodically (mostly semi-annual or annual) from the time of issuance until the maturity of the bond. These bonds come with a par value and a coupon rate, which is the bond's yield at the time of issuance. Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ... Coupon Bond Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. To claim your interest payment, you would simply clip off the ... home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016 [Solved] 1. A). What is the coupon rate for the bond? Assume semi ... Q: one year ago you bought a 10-year bond with 6% coupon rate (semi-annual payment) at the par value ($100) Right after you Q: A 6.50% coupon bond with 18 years left to maturity is offered for sale at $1,035.25.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 what is coupon for bond"